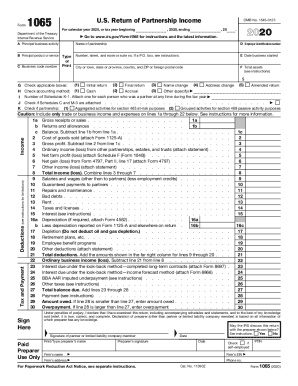

A married person can be claimed as a dependent only if:ī. The $9,000 loss on the sale of the personal use automobile is nondeductible. Randy must recognize a collectible gain of $10,000 on the sale of the coin collection. As a result of these sales, $1,000 is subject to income tax. He also sold a personal coin collection for a gain of $10,000. During the current year, Randy sold his personal use automobile for a loss of $9,000. The maximum tax rate of short-term gains held for one year or less is:Į. (0% × $10,000) + (12% × $2,000).Ĭollectibles and short-term capital gains are taxed at Darren's regular 12% tax bracket, while long-term capital gains are subject to a rate of 0% due to his income bracket. Short-term gain from the sale of a stock investmentĭarren's tax consequences from these gains would be:Į. Long-term gain from the sale of a stock investment He had the following capital asset transactions during the year: 1040 Schedule 4 Darren, who is single, is in the 12% tax bracket and his taxable income is $38,600. To file his taxes, he must use which of the following forms?Į.

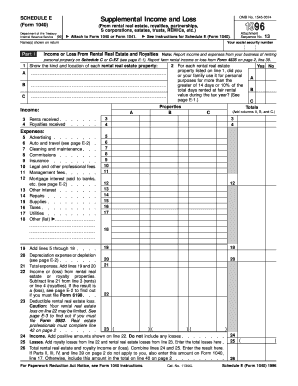

In 2019, John received $3,500 of interest income and has no earned income. James and Judy have one dependent child, John, who is 12. The e-file program to file tax returns for their clients. The e-file program to file tax returns for their clients.Į. Paper-based tax filing processes for their clients.ĭ. Either Form 1040 Schedule 1 or Form 1040 Schedule 2.Ĭ. In terms of timing as to any one year, the Tax Tables are available after the Tax Rate Schedules.įalse True It is mandatory for most tax return preparers to use:ī. The basic tax rate structure in the United States is:Į. 5 Gabriel is single and had taxable income of $1,300,000 in 2019. How many unique tax filing statuses are there?Į. Gross income is $425, and she does not need to file a tax return. Gross income is $375, and she needs to file a tax return.Į. Gross income is $375, and she does not need to file a tax return.ĭ. Gross income is $425, and she needs to file a tax return.Ĭ. Gross income is $800, and she needs to file a tax return.ī. What is Rebecca's gross income, and must she file a tax return?Ī.

During 2019, her sources of income are interest income of $425 from her bank savings account and interest income of $375 from tax-exempt municipal bonds. $3,100 Individuals must know their filing status to correctly compute both taxable income and the related income tax liability.įalse True Rebecca is a widow, age 69, who lives with her daughter and is her dependent. Gina's income for the year includes dividends of $2,100, earnings from babysitting of $1,000, nontaxable Social Security benefits of $10,000, and nontaxable interest from city bonds in the amount of $4,000. Miguel provides more than half the support of his aunt Gina who does not live with him.

0 kommentar(er)

0 kommentar(er)